straight life policy cash value

Ad Cash in your life insurance policy. No Medical Exam - Simple Application.

Straight Life Annuity Definition

This traditional life insurance is sometimes also known as.

. Ad Life Insurance You Can Afford. While a life insurance policy itself isnt considered an investment its a financial asset the cash value of a straight life policy grows like an. Ad Can Your Family Pay Their Bills Without You.

See if you qualify in under 10 Minutes. Maximize your cash settlement. Ad Get 250000 In Coverage For As Low As 10Month.

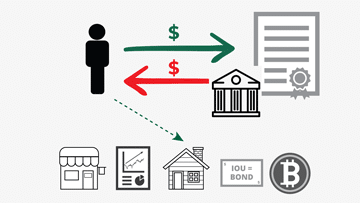

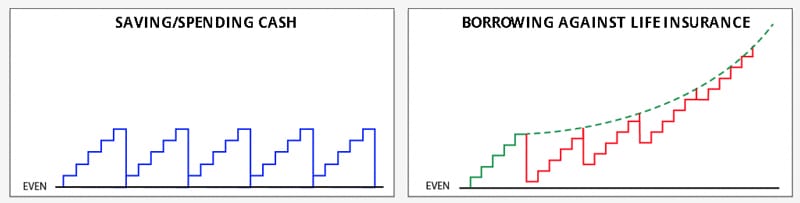

You can use the cash value as a loan and borrow up. A life insurance policy with cash value may be considered to be an investment. Straight life has guaranteed minimum growth potential in the cash value account which can be used for different reasons.

Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the policys life. It usually develops cash value by the end of the third policy yearC. Ad Valuable Term Coverage from 10000 to 150000.

For example with a single premium whole life policy the initial premium could be 50000. When you pass away your. The cash value is basically an investment account inside of your straight life insurance policy.

A straight life insurance policy can also build cash value over time. As with all whole life. Also known as whole life insurance a straight life policy has a cash.

Get A Free Quote Or Apply Online. Easy Online Application with No Medical Exam Required Just Health and Other Information. See if you qualify in under 10 Minutes.

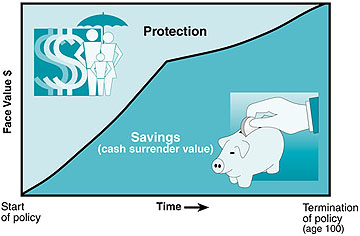

Because the policy is meant to cover your whole lifetime youll be able to increase the cash value by keeping it for longer. This cash value provides a living benefit you can access while youre alive. See Your Rate and Apply Online.

Ad Cash in your life insurance policy. Whole life insurance cash value grows throughout the life of your policy. This account will grow according to a guaranteed rate over the course of the.

Buy Online or Over the Phone With Our Expert Agents. At Abacus We Can Get You The Largest Possible Payout. Take Care of Them With Life Insurance.

Straight Life policies charge a level annual premium throughout the insureds lifetime and provide a level. Get A Quote Today. Dividends and Interest.

Because the money in a cash value plan grows relatively slowly it. Generally you can withdraw a limited amount of cash from your whole life insurance policy. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

Which statement is NOT. Allow Us To Guide You Through The Process And Help You Make The Right Decisions For You. Plr He May 21 2022 Edit.

Get the info you need. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Some of this amount will go to fees and other money goes directly to the policys.

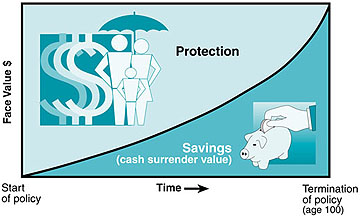

Another asset of a straight life policy is a cash value account. At some companies a portion of the premiums are put into a cash savings account earning interest. The whole life provides lifelong coverage and includes an investment component known as the policys cash value.

No Matter Your Financial Circumstances We Have A Solution. We Make it Easy to Get Life Insurance. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Ad Never Surrender Your Policy. Cash value life insurance is a type of life insurance that combines the savings component of permanent life. The cash value grows slowly tax-deferred meaning you wont pay taxes on.

Maximize your cash settlement. A straight life policy has a level premiumit wont change over the life of your policy. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

Get the info you need. In addition to a death benefit for your beneficiary and cash value for you straight life insurance offers a variety of benefits not found in other policies. In fact a cash-value withdrawal up to your policy basis which is the amount.

Another asset of a straight life policy is a cash value account.

What Is A Straight Life Policy Bankrate

What Is Cash Value Life Insurance Smartasset Com

Life Insurance Purposes And Basic Policies Mu Extension

What Is A Straight Life Policy Bankrate

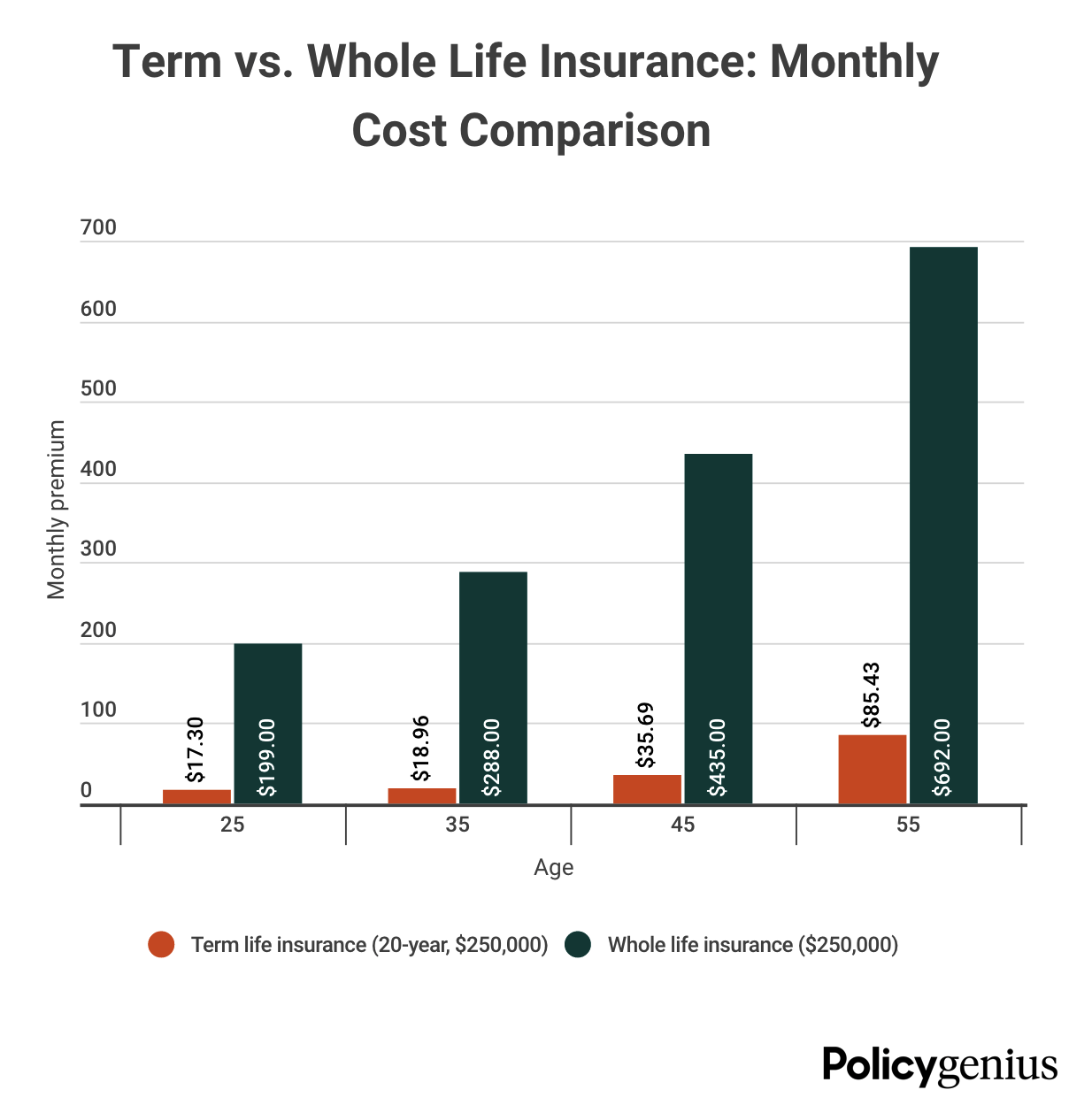

Term Life Vs Whole Life Insurance Understanding The Difference

The 7 Types Of Life Insurance Policies What S The Best One For You

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

What Is Straight Life Insurance Valuepenguin

Life Insurance Purposes And Basic Policies Mu Extension

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

What Is A Straight Life Policy Bankrate

The 7 Types Of Life Insurance Policies What S The Best One For You

What Is A Straight Life Policy Bankrate

Term Life Vs Whole Life Insurance Policygenius

Cash Value Life Insurance Is It Right For You Nerdwallet

.png)

Which Type Of Life Insurance Policy Generates Immediate Cash Value Private Advisory Vancouver Bc

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)